All Categories

Featured

Table of Contents

Term Life Insurance Policy is a sort of life insurance policy that covers the insurance holder for a details quantity of time, which is referred to as the term. The term sizes vary according to what the private picks. Terms usually range from 10 to thirty years and boost in 5-year increments, providing level term insurance.

They normally offer an amount of protection for a lot less than permanent kinds of life insurance coverage. Like any kind of plan, term life insurance has benefits and drawbacks depending upon what will certainly work best for you. The benefits of term life include price and the ability to tailor your term size and coverage amount based on your needs.

Depending on the type of policy, term life can use dealt with premiums for the whole term or life insurance policy on degree terms. The fatality advantages can be repaired.

*** Rates mirror plans in the Preferred And also Rate Course problems by American General 5 Stars My agent was extremely knowledgeable and helpful in the process. July 13, 2023 5 Stars I was pleased that all my demands were satisfied without delay and properly by all the representatives I spoke to.

The Basics: What is Direct Term Life Insurance Meaning?

All paperwork was electronically finished with access to downloading for individual data upkeep. June 19, 2023 The endorsements/testimonials offered ought to not be taken as a referral to purchase, or a sign of the worth of any item or service. The testimonies are actual Corebridge Direct customers that are not affiliated with Corebridge Direct and were not supplied settlement.

There are several kinds of term life insurance coverage plans. Rather than covering you for your entire life-span like whole life or global life plans, term life insurance policy only covers you for a designated amount of time. Policy terms typically range from 10 to 30 years, although much shorter and longer terms might be offered.

If you want to preserve insurance coverage, a life insurer might offer you the alternative to restore the policy for an additional term. If you added a return of premium cyclist to your plan, you would certainly receive some or all of the money you paid in costs if you have actually outlasted your term.

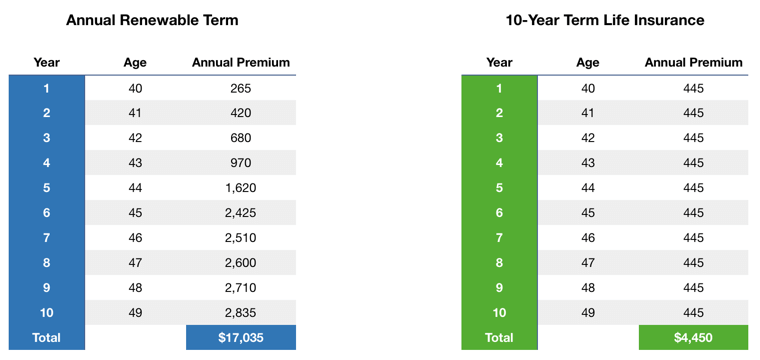

Level term life insurance policy may be the very best alternative for those that want insurance coverage for a collection duration of time and want their premiums to stay steady over the term. This may put on consumers concerned regarding the price of life insurance and those that do not intend to transform their death benefit.

That is due to the fact that term plans are not assured to pay out, while irreversible policies are, supplied all premiums are paid., where the fatality benefit lowers over time.

On the flip side, you might have the ability to safeguard a less costly life insurance coverage rate if you open up the policy when you're more youthful. Similar to advanced age, poor health can likewise make you a riskier (and extra pricey) prospect permanently insurance policy. However, if the problem is well-managed, you might still be able to locate inexpensive coverage.

How Does Level Premium Term Life Insurance Keep You Protected?

However, health and wellness and age are normally a lot more impactful costs factors than gender. High-risk hobbies, like diving and skydiving, might lead you to pay even more permanently insurance policy. Similarly, risky tasks, like home window cleansing or tree cutting, may additionally increase your cost of life insurance policy. The ideal life insurance policy company and policy will depend upon the individual looking, their individual ranking elements and what they require from their plan.

The very first step is to determine what you require the policy for and what your budget is. When you have a good concept of what you want, you may intend to compare quotes and policy offerings from numerous firms. Some firms use on-line quoting for life insurance coverage, but many require you to call a representative over the phone or face to face.

1Term life insurance uses momentary defense for a vital duration of time and is normally more economical than permanent life insurance policy. 2Term conversion standards and limitations, such as timing, might apply; for instance, there might be a ten-year conversion advantage for some items and a five-year conversion opportunity for others.

3Rider Insured's Paid-Up Insurance coverage Purchase Option in New York. There is a price to exercise this biker. Not all participating plan proprietors are eligible for rewards.

Our term life options consist of 10, 15, 20, 25, 30, 35, and 40-year policies. The most popular type is level term, indicating your payment (premium) and payment (survivor benefit) remains degree, or the same, up until completion of the term duration. Term life insurance level term. This is the most simple of life insurance policy options and needs extremely little maintenance for policy owners

For example, you could provide 50% to your partner and split the rest amongst your adult kids, a parent, a good friend, or perhaps a charity. * In some circumstances the survivor benefit might not be tax-free, discover when life insurance policy is taxable.

What is Level Premium Term Life Insurance? All You Need to Know?

There is no payment if the plan runs out before your death or you live past the plan term. You might be able to restore a term policy at expiry, but the costs will be recalculated based on your age at the time of revival.

At age 50, the costs would certainly increase to $67 a month. Term Life Insurance coverage Fees 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life plan, for guys and females in excellent health and wellness.

Interest prices, the financials of the insurance policy business, and state laws can likewise influence premiums. When you think about the quantity of insurance coverage you can obtain for your premium dollars, term life insurance has a tendency to be the least pricey life insurance.

Latest Posts

Difference Between Burial Insurance And Life Insurance

Companies That Sell Burial Insurance

Funeral Policy Cover