All Categories

Featured

Table of Contents

They normally provide a quantity of protection for much less than irreversible kinds of life insurance. Like any type of policy, term life insurance has advantages and downsides depending on what will function best for you. The advantages of term life include cost and the capacity to personalize your term length and protection amount based upon your needs.

Depending on the kind of plan, term life can offer set premiums for the whole term or life insurance policy on degree terms. The death benefits can be taken care of as well. Since it's an economical life insurance coverage item and the payments can stay the very same, term life insurance policy plans are preferred with youngsters simply beginning, households and individuals that want protection for a details time period.

Outstanding Does Term Life Insurance Cover Accidental Death

Fees reflect plans in the Preferred Plus Rate Course issues by American General 5 Stars My agent was very knowledgeable and handy in the procedure. July 13, 2023 5 Stars I was satisfied that all my needs were met immediately and expertly by all the agents I talked to.

All paperwork was electronically finished with accessibility to downloading and install for personal documents upkeep. June 19, 2023 The endorsements/testimonials provided need to not be construed as a recommendation to purchase, or a sign of the worth of any item or service. The endorsements are real Corebridge Direct customers who are not affiliated with Corebridge Direct and were not offered payment.

1 Life Insurance Stats, Data And Industry Trends 2024. 2 Expense of insurance coverage rates are determined making use of approaches that vary by firm. These prices can vary and will normally raise with age. Prices for energetic workers may be various than those offered to terminated or retired employees. It is essential to take a look at all factors when reviewing the overall competition of rates and the value of life insurance policy coverage.

Term Vs Universal Life Insurance

Like most group insurance coverage plans, insurance coverage plans offered by MetLife consist of certain exemptions, exceptions, waiting durations, decreases, limitations and terms for keeping them in force (decreasing term life insurance is often used to). Please contact your benefits administrator or MetLife for costs and total details.

Essentially, there are 2 kinds of life insurance prepares - either term or permanent plans or some mix of both. Life insurance providers provide numerous forms of term strategies and traditional life plans along with "passion sensitive" products which have come to be more widespread because the 1980's.

Term insurance supplies defense for a specified amount of time. This duration might be as brief as one year or supply protection for a details number of years such as 5, 10, twenty years or to a defined age such as 80 or in many cases up to the earliest age in the life insurance policy mortality.

Level Term Life Insurance Meaning

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg)

Presently term insurance prices are very competitive and amongst the most affordable historically knowledgeable. It must be noted that it is a widely held idea that term insurance policy is the least pricey pure life insurance policy coverage available. One requires to assess the plan terms thoroughly to decide which term life options are appropriate to satisfy your specific circumstances.

With each brand-new term the costs is increased. The right to renew the plan without proof of insurability is a crucial benefit to you. Or else, the risk you take is that your wellness may wear away and you may be incapable to acquire a plan at the exact same rates and even whatsoever, leaving you and your recipients without insurance coverage.

You must exercise this alternative throughout the conversion period. The size of the conversion period will vary relying on the sort of term policy purchased. If you convert within the recommended period, you are not called for to give any type of information about your health and wellness. The costs price you pay on conversion is typically based upon your "existing achieved age", which is your age on the conversion date.

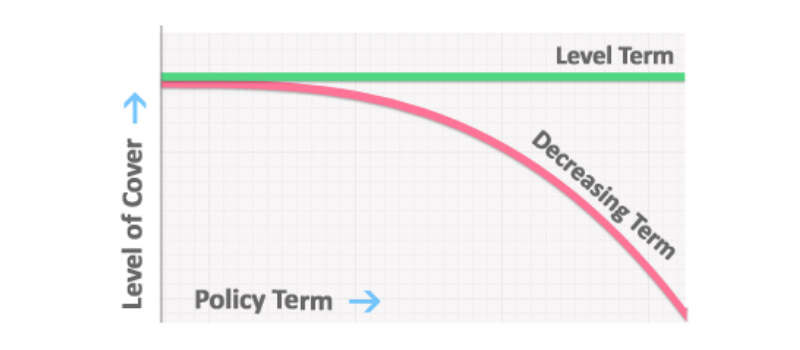

Under a level term plan the face quantity of the plan continues to be the exact same for the entire period. With decreasing term the face amount minimizes over the period. The premium remains the exact same each year. Commonly such plans are sold as home loan security with the quantity of insurance lowering as the balance of the mortgage reduces.

Typically, insurers have not deserved to alter costs after the policy is sold (which of these is not an advantage of term life insurance). Considering that such policies may continue for years, insurance companies must use traditional mortality, interest and expense price price quotes in the costs estimation. Flexible premium insurance coverage, nonetheless, permits insurance companies to supply insurance policy at lower "existing" costs based upon much less conventional assumptions with the right to transform these costs in the future

Term Life Insurance For Couples

While term insurance is made to provide security for a specified period, irreversible insurance is designed to supply insurance coverage for your entire lifetime. To maintain the premium price level, the premium at the younger ages goes beyond the actual cost of defense. This extra premium develops a reserve (cash value) which helps pay for the policy in later years as the price of security surges above the costs.

The insurance policy firm invests the excess premium bucks This type of policy, which is in some cases called cash money value life insurance coverage, creates a savings element. Cash money values are important to an irreversible life insurance coverage plan.

Term Life Insurance With Accelerated Death Benefit

Occasionally, there is no connection in between the dimension of the cash money value and the premiums paid. It is the cash value of the policy that can be accessed while the insurance holder lives. The Commissioners 1980 Standard Ordinary Mortality Table (CSO) is the existing table made use of in calculating minimal nonforfeiture values and plan gets for normal life insurance policy plans.

There are two fundamental groups of permanent insurance coverage, traditional and interest-sensitive, each with a number of variations. Traditional entire life plans are based upon long-term quotes of expense, passion and death (short term life insurance).

If these quotes change in later years, the firm will certainly adjust the premium as necessary but never over the optimum ensured costs specified in the plan. An economatic entire life plan offers a fundamental quantity of getting involved whole life insurance policy with an additional supplementary protection provided with using dividends.

Due to the fact that the costs are paid over a shorter period of time, the premium settlements will certainly be greater than under the entire life strategy. Single premium entire life is limited repayment life where one big superior repayment is made. The policy is fully paid up and no more costs are required.

Latest Posts

Difference Between Burial Insurance And Life Insurance

Companies That Sell Burial Insurance

Funeral Policy Cover