All Categories

Featured

Table of Contents

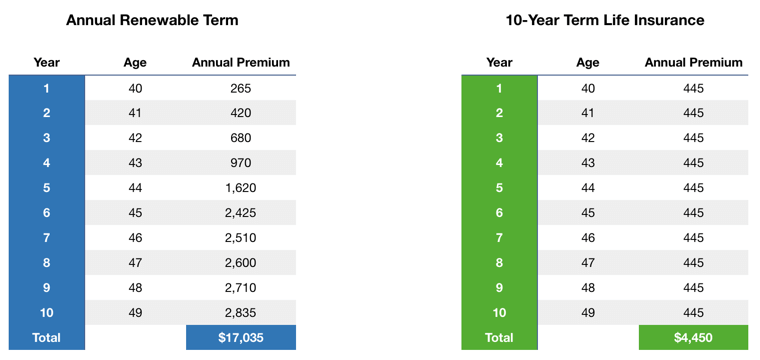

That commonly makes them a much more budget friendly option permanently insurance coverage. Some term plans may not maintain the premium and fatality benefit the same in time. Term Life Insurance. You don't wish to wrongly assume you're acquiring degree term protection and after that have your fatality advantage change later. Many individuals get life insurance policy coverage to assist monetarily secure their enjoyed ones in situation of their unanticipated fatality.

Or you may have the option to transform your existing term protection right into a long-term policy that lasts the remainder of your life. Various life insurance coverage policies have potential advantages and drawbacks, so it's vital to recognize each prior to you make a decision to buy a policy.

As long as you pay the premium, your recipients will certainly receive the death advantage if you pass away while covered. That said, it is very important to note that most plans are contestable for 2 years which implies insurance coverage might be rescinded on fatality, ought to a misrepresentation be discovered in the app. Plans that are not contestable typically have actually a graded survivor benefit.

What is the Coverage of Term Life Insurance?

Costs are typically less than whole life policies. With a level term policy, you can choose your protection quantity and the plan length. You're not locked right into a contract for the rest of your life. Throughout your plan, you never ever need to bother with the premium or survivor benefit amounts changing.

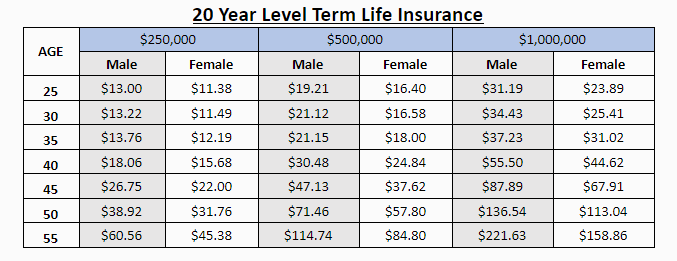

And you can't squander your plan during its term, so you will not obtain any type of financial take advantage of your past coverage. Similar to various other kinds of life insurance policy, the expense of a level term plan depends on your age, coverage requirements, work, way of living and health. Normally, you'll discover more cost effective protection if you're younger, healthier and less high-risk to insure.

Given that level term premiums stay the very same throughout of protection, you'll recognize precisely just how much you'll pay each time. That can be a big assistance when budgeting your costs. Level term insurance coverage additionally has some versatility, permitting you to customize your plan with additional attributes. These often come in the form of riders.

How Does Term Life Insurance Level Term Protect Your Loved Ones?

You might have to satisfy certain problems and credentials for your insurance firm to establish this biker. There also might be an age or time restriction on the protection.

The fatality benefit is normally smaller sized, and protection generally lasts till your youngster turns 18 or 25. This motorcyclist might be a more economical way to help ensure your children are covered as motorcyclists can typically cover numerous dependents simultaneously. As soon as your youngster ages out of this insurance coverage, it might be possible to convert the motorcyclist into a brand-new plan.

The most typical kind of long-term life insurance policy is whole life insurance coverage, yet it has some vital differences compared to degree term protection. Below's a basic overview of what to take into consideration when contrasting term vs.

What is Term Life Insurance With Level Premiums? Pros, Cons, and Considerations?

Whole life entire lasts for life, while term coverage lasts insurance coverage a specific periodParticular The costs for term life insurance are usually reduced than entire life coverage.

One of the major attributes of degree term protection is that your costs and your death benefit do not alter. With decreasing term life insurance, your costs remain the same; nonetheless, the death advantage quantity gets smaller gradually. You might have coverage that starts with a death benefit of $10,000, which might cover a home mortgage, and then each year, the fatality benefit will lower by a collection quantity or percent.

Due to this, it's frequently a much more inexpensive type of degree term protection., however it might not be enough life insurance coverage for your needs.

What is Life Insurance and How Does It Work?

After choosing on a plan, complete the application. For the underwriting process, you may have to offer basic individual, health, lifestyle and work info. Your insurance firm will identify if you are insurable and the danger you might provide to them, which is mirrored in your premium prices. If you're authorized, sign the documents and pay your initial costs.

You may want to upgrade your beneficiary details if you've had any kind of considerable life modifications, such as a marital relationship, birth or separation. Life insurance can sometimes feel challenging.

No, level term life insurance coverage doesn't have cash worth. Some life insurance policy plans have an investment function that allows you to build cash value with time. A part of your costs payments is set apart and can earn passion with time, which expands tax-deferred throughout the life of your coverage.

You have some alternatives if you still desire some life insurance policy protection. You can: If you're 65 and your insurance coverage has actually run out, for instance, you might desire to get a brand-new 10-year level term life insurance coverage plan.

How Do You Define Level Benefit Term Life Insurance?

You may be able to transform your term coverage right into an entire life plan that will last for the remainder of your life. Several kinds of level term policies are exchangeable. That implies, at the end of your protection, you can convert some or all of your plan to whole life insurance coverage.

A degree costs term life insurance policy strategy lets you stay with your budget plan while you help secure your family. Unlike some tipped rate strategies that raises yearly with your age, this kind of term strategy provides rates that remain the exact same through you choose, even as you get older or your wellness modifications.

Discover more about the Life insurance policy options readily available to you as an AICPA member (Direct term life insurance meaning). ___ Aon Insurance Providers is the trademark name for the brokerage firm and program management procedures of Affinity Insurance coverage Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in Alright, AIS Affinity Insurance Solutions Inc.; in CA, Aon Affinity Insurance Policy Services, Inc .

Latest Posts

Difference Between Burial Insurance And Life Insurance

Companies That Sell Burial Insurance

Funeral Policy Cover